BEST DAY TO TRADE FOREX

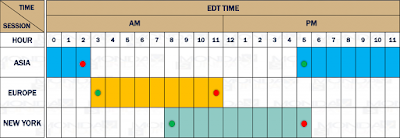

We already know that the London session is the busiest compared to other sessions, but there are also a few days a week where all markets tend to show more movement. ===== Here are the best days to trade forex : ===== As you can see from the chart above, it is the best time to trade in the middle of the week following many big movements occurs. On Fridays, the market usually moves fast until 12:00 pm and then moves slowly as it is close to the closing time of the session at 3:00 am. This means, we only work half a day on Fridays. Busy times which all traders all over the world enter the market are usually the best time to trade as high volatility will provide a great opportunity to enter trading positions To get connected with forex market, connect with us on telegram channel: VIP FOREX KING