THE BEST TIME TO TRADE FOREX

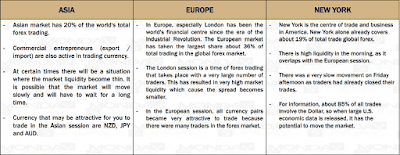

Usually, the market will be very active when two or more markets overlap at one time and the overlap time which is very popular for traders to trade The best time to trade is during overlaps in trading periods between open markets. Overlaps equal higher price ranges, resulting in increased opportunities. Here’s a closer look at the three overlappings that happen every day:

=====

US/LONDON

=====

US/London the largest overlap in the US/London market. For your information, 70% of all trades occur when these markets overlap because the US dollar and the euro are the two most common trading currencies. As the volatility is high, this is the most strategic time to enter the market.

=====

SYDNEY/LONDON

=====

Sydney/Tokyo this period of time is not as volatile as the US/London overlap, but it still offers an opportunity to trade in a duration of larger pip fluctuations.

=====

LONDON/TOKYO

=====

London/Tokyo: This overlap shows the least amount of movement because of the time (some US traders ignore this timeframe) and the one-hour overlap gives very few chances to view major pip changes happen.

However, first thing in the morning, market volumes and prices can go crazy. After the previous market closed, the news releases of the opening hours will represent the market in which become the main factor of the prices goes wild. A skilled trader may be able to recognize the appropriate patterns and make a fast profit, but a less skilled trader may suffer significant losses. So, if you are a beginner, during these volatile hours, or at least during the first hour, you may want to avoid trading.

To get connected with forex market and latest updates, follow us on telegram channel:

Comments

Post a Comment